How a Traditional VC Could Approach Crypto / Web 3

Why Crypto, Why Now, and How to Approach the Space

Hi frens 👋,

Those who know me know that I’ve been excited about crypto / web 3 for many years (I use these terms interchangeably). Crypto is one of the hottest spaces today, but many traditional investment firms still don’t understand or know how to approach the space.

A few months ago, I wrote a memo to help firms understand the investment opportunity in crypto. Today, I’m open sourcing my writing in hopes that it can help others. This piece discusses why and how a traditional VC could approach crypto. Whether you’re an investor, builder, or just casually curious about crypto / web 3, I hope you find this post helpful.

Let’s dive in.

Introduction

Since Bitcoin’s launch over 13 years ago, the crypto ecosystem has developed at a rapid rate. Ethereum’s launch in 2015 accelerated activity in the space by showing the broader potential of blockchain technology. With each major crypto market cycle (peaks: 2011, 2013, 2017), user adoption and developer activity reached new heights. After the market cycle in 2017, many protocols and businesses were built that would later enable the influx of user activity in 2020 and 2021. Over the last 1.5 years, adoption and activity in the space have exploded, catalyzed by COVID’s global macroeconomic impact.

Unlike the 2017 market cycle, we’re seeing use cases beyond speculation, attractive growth-stage investment opportunities, a predominantly institutional market, and an influx of high-quality talent into the space. However, we’ve seen these boom-bust cycles before. Given the exuberance in both crypto and capital markets more broadly, there could be significant volatility over the short-term, but crypto’s long-term potential and growth trends are clear.

Over the last twelve months, traditional investment firms – VCs, hedge funds, and growth equity firms – have often asked how they could enter crypto. Many firms have shifted from asking themselves should we invest in crypto to what is our strategy? My goal with this memo is to articulate why and how a traditional firm could invest in the space.

This memo covers the following topics: why crypto, why now, a framework to approach crypto, and a proposed investment strategy. I discuss some of the current and potential use cases with crypto, how consumer adoption evolved with prior major technology shifts, and where crypto adoption is today. I then provide a conceptual framework for the space, a potential investment strategy, and highlight a couple of interesting sectors.

Why Crypto?

Crypto represents a multi-decade, multi-trillion-dollar market opportunity and a computing paradigm shift that has the potential both to create new industries and to disrupt existing industries, from finance to the internet and gaming. Many of the next generational companies will be crypto-native and will likely be created over the next 5-10 years.

Just like the internet in the 1990s and smartphones in the late 2000s, crypto is enabling a new class of applications that take advantage of its unique capabilities. Companies like Uber and Instagram took advantage of the smartphone’s unique features of mobile GPS and high-resolution cameras. Similarly, protocols like Bitcoin and Ethereum are taking advantage of crypto’s unique features of trust, digital scarcity, immutability, and embedded financial incentives.

Put simply, crypto’s unique features can create better customer experiences and align incentives between consumers and platforms. The most valuable applications will likely be difficult to predict and will be the result of entrepreneurs iterating on ideas, as was the case for the internet and mobile. Below are some examples of applications that we see today.

Financial Services ($10T+ TAM1), Payments ($500B+ TAM): Crypto can enable a faster, cheaper, more transparent, and more inclusive financial system, from banking to insurance.

Gold ($8T+ TAM): A more portable, secure, divisible, and durable version of gold.

Gaming ($175B+ TAM2): Gamers can directly own the virtual goods they earn or purchase on platforms. Gamers and developers can financially own, govern, and earn money through the platform.

Social Networks ($70B+ TAM3): Consumers can use social networks without exposing their personal data and financially partake in the platforms’ success.

Creator Economy ($35B Music TAM): Artists, musicians, and creators can directly engage with fans and own and monetize their content without paying fees to intermediaries. Creators, athletes, influencers, or any individual can raise capital from a community and invest in the success of others through social tokens.

In addition to crypto native applications, there is an emerging ecosystem of crypto enablement platforms that allow consumers, businesses, and developers to access or build in the crypto markets. These enablement platforms include crypto on/off ramps, trading infrastructure, NFT marketplaces, wallets, developer tools, and service providers (tax, research, analytics, etc.), among others.

Why Now?

Transformational technologies often follow an S-curve of adoption in which user adoption rises slowly, then accelerates significantly, and finally gradually plateaus. The most successful companies that emerge from these paradigm shifts are often founded at the beginning of the S-Curve inflection point.

Exhibit 1 illustrates the adoption curves for the internet and smartphones. Many of the most valuable tech businesses founded during these periods are overlaid above the chart and sorted by the years they were founded. My takeaways from the data are three-fold:

Rapid technology adoption occurs over a narrow period. U.S. / Chinese internet adoption and U.S. smartphone adoption rapidly accelerated over 6-to-8-year periods. U.S. Internet adoption inflected from 5% in 1994 to 60% by 2002 (6.5% per year), and U.S. smartphone adoption inflected from 20% in 2010 to 65% by 2016 (7.5% per year). Similarly, Chinese internet adoption inflected from 9% in 2005 to 45% by 2013 (4.5% per year).

The most valuable companies were founded early in the adoption phase. Across the U.S. and China, many of the most valuable internet and mobile companies were founded before or within the first 3-5 years of the S-curve inflection point.

B2B lags consumer. As we’ve often seen, B2B technology adoption tends to lag consumer. This was the case for the internet, in which the shift towards cloud-based SaaS products emerged after AWS’ launch in 2006 (~12 years after the consumer internet’s inflection point).

Exhibit 1: Internet and Smartphone Adoption

Crypto is potentially at this S-curve inflection point. Importantly, we will likely see faster rates of adoption with crypto than with prior technology shifts because crypto is purely software, open-source, composable, and accessible to everyone in the world.

Given crypto’s pseudonymous nature, it’s difficult to accurately determine crypto adoption across populations. However, Gemini estimates that ~14% of the U.S. population owns cryptocurrencies, and Chainalysis suggests global crypto adoption has skyrocketed by 10x in the last year and 17x in the last 2 years.

Exhibit 2: Chainalysis Global Crypto Adoption Index

We can also glean insights from transactional activities because of crypto’s transparent nature. Over the last few years, crypto’s market cap, trading volume, NFT transaction volume, and DeFi activity have exploded. Startup and developer activity have also steadily grown, suggesting ample investment opportunities.

(Note: market data as of September 30, 2021 unless otherwise noted)

Crypto Tokens Market Cap: $2.1T (+500% y/y)

BTC Dominance: 42% (down from 58% Oct 2020)

Spot Trading: $15T run-rate (RR) volume (+630% y/y)

Bitcoin Futures Trading: $19T RR volume (+400% y/y)

NFT Transactions4: $32B RR volume (~$0 one year ago)

Total Value Locked in DeFi: $140B (+830% y/y)

1.8K deals in 2021 YTD (+126% vs. 2020)

$36B investments excluding IPOs (+420% vs. 2020)

BTC Wallet Addresses: 870M total (+25% y/y)

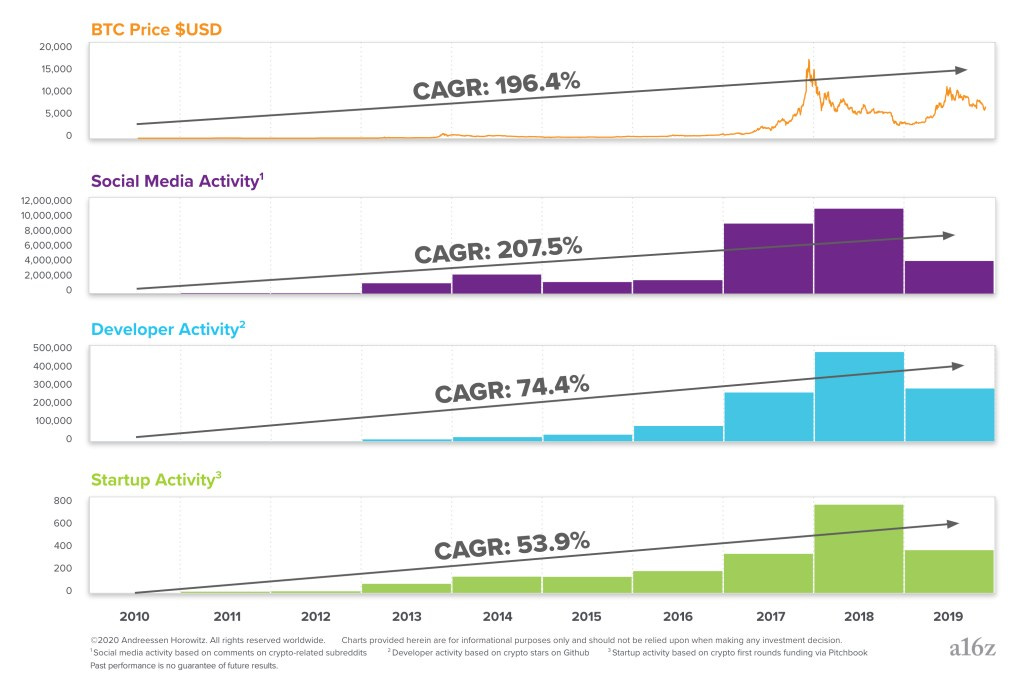

While recent activity is impressive, we could see short-term volatility and should invest selectively. At the same time, it’s important to maintain a broader perspective. Historically, market cycles have moved the space forward by bringing in more consumers, developers, and entrepreneurs for the long-term. Per exhibit 3, each market cycle can bring significant short-term volatility, but user adoption and developer / startup activity have grown steadily over time. Crypto market bubbles can bring in tourists to the space, so it’s important to invest in entrepreneurs building for the long-term.

Exhibit 3: Crypto Market Cycles

A Framework for Crypto

One way to think about opportunities in the space is across two dimensions: security (equity vs. token) and use case (infrastructure vs. application). Although the lines across dimensions are often blurry, this rough framework can be helpful in organizing the space. Exhibit 4 illustrates this framework along with companies in each quadrant.

Exhibit 4: Crypto Opportunity Framework

Security: Equity vs. Token

One of crypto’s unique innovations is the ability to financially align stakeholders of a platform with its native token. The token gives holders access to the network’s services, acts as a financial investment, and can provide governance rights. From governance and financial perspectives, a token investment shares similar qualities with an equity investment. Thus far, tokens have accrued most of the value in the space and their paths to liquidity can be faster than equities.

However, sourcing and evaluating a token investment in a protocol is different than doing so for an equity investment in a company. Unlike a traditional tech company, a protocol has minimal intellectual property (the code is open source), its network effects are the primary moat, its token economics are often driven by supply and demand rather than cash flows, its technology can be complex and important to understand, and its governance is more global and communal. Token investing may require a dedicated crypto fund and/or firm restructuring. Additionally, it will be important to have analytical tools to measure on-chain crypto activities.

Equity investments are an attractive way to enter the market. These businesses are generally easier to understand than tokens since the financial security is well understood, and the business models are often analogous to the fiat world. Compared to token investments, equity investments can provide exposure to the broader asset class while reducing market correlation and volatility. Equities can also carry less legal and regulatory risk and offer a stronger moat via proprietary technology. On the other hand, equities likely capture a smaller portion of the value generated by the asset class, can be slower to build and scale, and have less virality and network effects.

Use Case: Infrastructure vs. Application

Infrastructure refers to equities or protocols on top of which applications are built. Infrastructure tokens would include layer 1 smart contract, privacy, web 3, and gaming infrastructure platforms. Infrastructure equities would include crypto-as-a-service APIs, data APIs, institutional trading infrastructure, and NFT developer tools, among others.

The benefit of infrastructure investing is exposure to the asset class while reducing risk to any particular use case. However, infrastructure products can be technically complex, particularly on the token side, and there may be fewer winners than applications.

Applications refer to products built around specific use cases. Examples of equities include exchanges, prime brokerages, NFT marketplaces, service providers (tax software, data analytics, etc.), crypto banks, wallets, and gaming studios. Examples of tokens include social networks, creator economy platforms, and DeFi building blocks (lending, exchanges, asset management, etc.).

The advantages for investing in applications are that they are easier to understand, the universe of applications could be larger than infrastructure over the long-term, they can become highly valuable if successful, and they can accelerate crypto adoption. However, determining which use cases will succeed can be difficult and the current crypto infrastructure may not be ready for mainstream token applications.

Investment Strategy

Over the long-term, I believe both tokens and traditional equity businesses will have important roles in the crypto space. Although tokens have captured most of the value in the space so far, there will likely be many generational equity businesses supporting the ecosystem as well. Therefore, I believe the optimal long-term crypto investment strategy would include both equities and tokens.

However, an attractive investment strategy for a traditional VC in the short-to-medium term could be to deploy a picks-and-shovels approach in equities across infrastructure and applications. These companies would provide exposure and insight to the asset class, have relatively lower market risk, are easiest to understand, and are the most like other technology businesses. Over time, a traditional VC could build its token portfolio as the firm builds comfort, institutional knowledge, and a valuation framework.

During the internet and mobile eras, investing in both infrastructure/platform businesses and applications would have yielded optimal results. An infrastructure / platform investment strategy could have included companies such as Apple ($2.4T market cap), AWS, and Shopify ($170B). An application-focused strategy could have also been highly successful with companies like Google ($1.8T), Amazon ($1.7T), Facebook ($970B), Snapchat ($120B), and Uber ($90B).

Select Sector Case Studies

To bring the crypto strategy to light, I’ve highlighted a couple of sectors with attractive investment opportunities. Below is a snapshot of various sectors – though not fully exhaustive – sorted by security type and market risk. Market risk is a subjective measure that takes into consideration exposure to market prices, regulatory risk, sector maturity, customer base, and execution risk.

Exhibit 5: Crypto Industry Overview

Institutional Trading (Equity)

This sector is an example of an attractive investment area with growth-stage companies that provide crypto market exposure, reduce direct price exposure, operate in large, quickly growing markets, and are foundational to the crypto space. Companies in this sector are equity businesses that enable traditional financial institutions to access crypto, effectively bridging the two worlds. These products include prime brokerage, spot and futures trading, margin trading, lending, custody, treasury management, and crypto-as-a-service. Spot trading volume is ~$15T RR (+630% y/y), Bitcoin futures trading volume is ~$19T RR (+400% y/y), and institutions now comprise ~70% of volume versus 30% in 2018.

FalconX is an example of an attractive investment opportunity in the space. It is a crypto prime brokerage offering institutions trading, credit, clearing, and white glove services. During the last crypto market cycle in 2017, institutional customers wanted access to crypto, but found that there was a dearth of companies that provided the services they needed. FalconX saw an opportunity to build a modern, API and web-based trading platform that offered institutional customers instant, guaranteed trading prices across a global liquidity pool. Rather than trade on a single venue with limited liquidity or place block trades on the phone through an OTC desk, institutions could access the best prices across the world and minimize slippage costs instantly through an API.

FalconX launched its first product in 2019 and has seen explosive growth, catalyzed by the crypto market’s bull run. In Q2 2021, the company achieved $120B RR volume and revenue growth of 30x y/y with strong profitability and unit economics. FalconX capitalizes on a proven use case and has breakout potential of 5-10x+ if things go right.

However, the business is indirectly correlated to crypto market performance and volatility and is a transactional business. Over the long-term, prime brokerage could become commoditized and the company will likely face compressed fees and increasing competition. Like with many excellent businesses in crypto, FalconX’s valuation and stage could be deterrents for a traditional VC.

Crypto Gaming (Token)

While still early in development, the crypto gaming sector is a great example of a blooming application. Gaming platforms like Axie Infinity and Star Atlas are showing us the paradigm shift unfolding in gaming and have the potential to bring in the next large wave of crypto adopters.

At $175B and growing at a 9% 5-year CAGR, the global gaming market is massive and growing at scale. Gaming is becoming the new social, and people are increasingly spending their time in games and the metaverse. For example, Roblox has 42M DAUs who spend ~2.5 hours per day, or ~25% of their free time5, on the platform. While impressive, consider how much time people will spend when they get paid to play.

In Web 2, most gaming value accrues to the gaming publisher typically through the free-to-play model. This model has been highly effective at creating large installed user bases that can be monetized through virtual goods (or items and skills in the case of pay-to-win). However, these items aren’t technically owned by the users, they’re not portable across games, and the platforms can change the rules.

Crypto gaming is turning Web 2 gaming on its head, and the community reaction is remarkable. Using Axie Infinity as an example, users own their digital goods as NFTs, financial own and govern the platform, and earn money for playing the game (“play-to-earn”). Despite still being in alpha and having a user onboarding experience filled with friction, Axie has over 500K DAUs and 800K members on its Discord (the maximum number allowed). Axie is generating $2.2B RR revenue (+1,400x y/y), and its revenue over the last 90 days was second to Ethereum and 13x+ greater than the revenue of other protocols6.

However, there are numerous risks. Gaming is notoriously fickle and hard to predict. Axie is still early in its product roadmap and will need to continue attracting users and developers to the platform. The user onboarding experience is poor, and the platform could have throughput constraints on Ronin (Axie’s layer 2 Ethereum side chain) and Ethereum. Axie’s success will also bring in more competition.

Axie could be an attractive opportunity, but the broader takeaway is the shift happening in gaming. Crypto is unlocking new use cases and business models. It’s better aligning user and platform incentives, demonstrating the speed and power of global network effects. This new gaming paradigm is enabling exciting applications and investment opportunities.

Conclusion

Many of the most important and valuable companies in the world over the next few decades will likely be crypto companies. We could be at the beginning of the crypto adoption inflection point, and the rate of adoption will likely be faster than prior technology shifts we’ve seen in the past.

Investors have a unique window of opportunity to partner with the leading entrepreneurs and companies in the space. Despite volatility and uncertainty over the short-term, the long-term trends in crypto are attractive. A pick-and-shovels investment strategy would be an appealing way for a traditional VC to invest in the space until the firm is comfortable investing directly into tokens. If things go right, crypto is an incredible opportunity to seize.

Could we still be early? Most likely. But as most investors will tell you, timing the market is a fool’s game. Given the magnitude of opportunity in crypto and the space’s rate of development, every firm should be allocating a portion of their time and resources to crypto.

The web 3 wave is too big to ignore. And when you see the next big wave, you just need to start paddling as hard as you can.

Other Resources

Bitcoin For The Open Minded Skeptic - Matt Huang at Paradigm

Why Decentralization Matters - Chris Dixon at a16z

Chis Dixon and Naval Ravikant (podcast) - The Tim Ferriss Show

Evercore ISI – Ready, Aim, Monetize: Initiating Coverage of U.S. Video Game Publishers (November 16, 2020)

Includes U.S. social networks ($63B) and China social networks ($8B)

NFT volume includes art, collectibles, gaming, and marketplaces

Q2 2021 Roblox company filings. % of total free time defined as (hrs engaged per DAU per day) * (7 days / week) / (Total Free Time per Week per DAU). Free time per week equal to ~67 hours: assumes 8 hours of sleep 7 days per week and 9 hours of work/school 5 days per week

Market data as of October 7, 2021

I believe Polkadot is a Level 0 Blockchain?